SWIFT FIN Component Features

The SWIFT FIN component runs on top of Integration Server and provides the following functionality:

Current Messages

The component supports the following SWIFT messages:

The latest release of SWIFT FIN messages.

The SWIFT Standards MX messages.

Data Field Dictionary

The SWIFT FIN component provides a data field dictionary (DFD) based on the ISO 15022 standards for SWIFT FIN messages. This DFD enables translation of a message tag number (for example, “22F::SFRE”) into a meaningful business name (for example, “Statement Frequency Indicator”). In addition, the SWIFT FIN component enables you to choose how you want to display each message in Software AG Designer as follows:

Tag number only (for example, “22F::SFRE”)

Equivalent message business name only (for example, “Statement Frequency Indicator”)

Both the tag number and the equivalent message business name (for example, “22F::SFRE_Statement Frequency Indicator”)

XML data tag (for example, “22FSFRE”)

Message Archival

All SWIFT FIN messages can be archived in Trading Networks.

SWIFT Interfaces

The SWIFT FIN component provides out-of-box support to interface to SWIFT using MQHA, CASmf, and AFT. For more information, see

Configuring SWIFT Interfaces.

Bank Directory Plus Validation and Searching

The SWIFT FIN component provides support for deriving or validating data against Bank Directory Plus. Bank Directory Plus is a SWIFT directory that contains identifiers recognized by financial institutions, such as Bank Identifier Codes (BICs), International Bank Account Numbers (IBANs), and national clearing codes. Bank Directory Plus serves two main purposes:

To provide or validate data in international payment messages, for example to translate the beneficiary bank's BIC into national (clearing, sort) code, or validate the banks' details (such as name and address).

To provide or validate data in SEPA (Single Euro Payment Area) payments, for example, to derive the BIC from the IBAN if the IBAN is missing, or to validate IBAN/BIC combinations.

Syntax and Network Validation

The SWIFT FIN component enables you to validate the message structure, field formats, and network rules of inbound and outbound SWIFT FIN messages.

SWIFT Module provides network validation rules for a few commonly used message types. In addition to these rules, the component enables you to create network, Market Practice, and usage validation rules for additional messages as well. For more information, see

Creating Validation Rules and

Working with Market Practices.

Market Practices

Market Practices are specific requirements for individual markets. Using Trading Partner Agreements (TPAs), the SWIFT FIN component supports customization of SWIFT FIN messages based on specific trading partner pairs. For more information about SWIFT-related Market Practices and TPAs, see

Working with Market Practices and

Customizing Trading Partner Agreements.

Processing Rule Support

You can use custom-created Trading Networks processing rules for each SWIFT message record. For information about creating processing rules, see webMethods Trading Networks Administrator’s Guide.

SWIFT Error Codes

The component supports SWIFT error codes for field level and network validation. It also supplies resource bundles so that all error codes can be localized.

Integration Server

Integration Server Clustering

Subfield Parsing

The SWIFT FIN component automatically parses messages into blocks and fields. You can configure further parsing into subfields with the subfieldFlag variable, which is included in the following services:

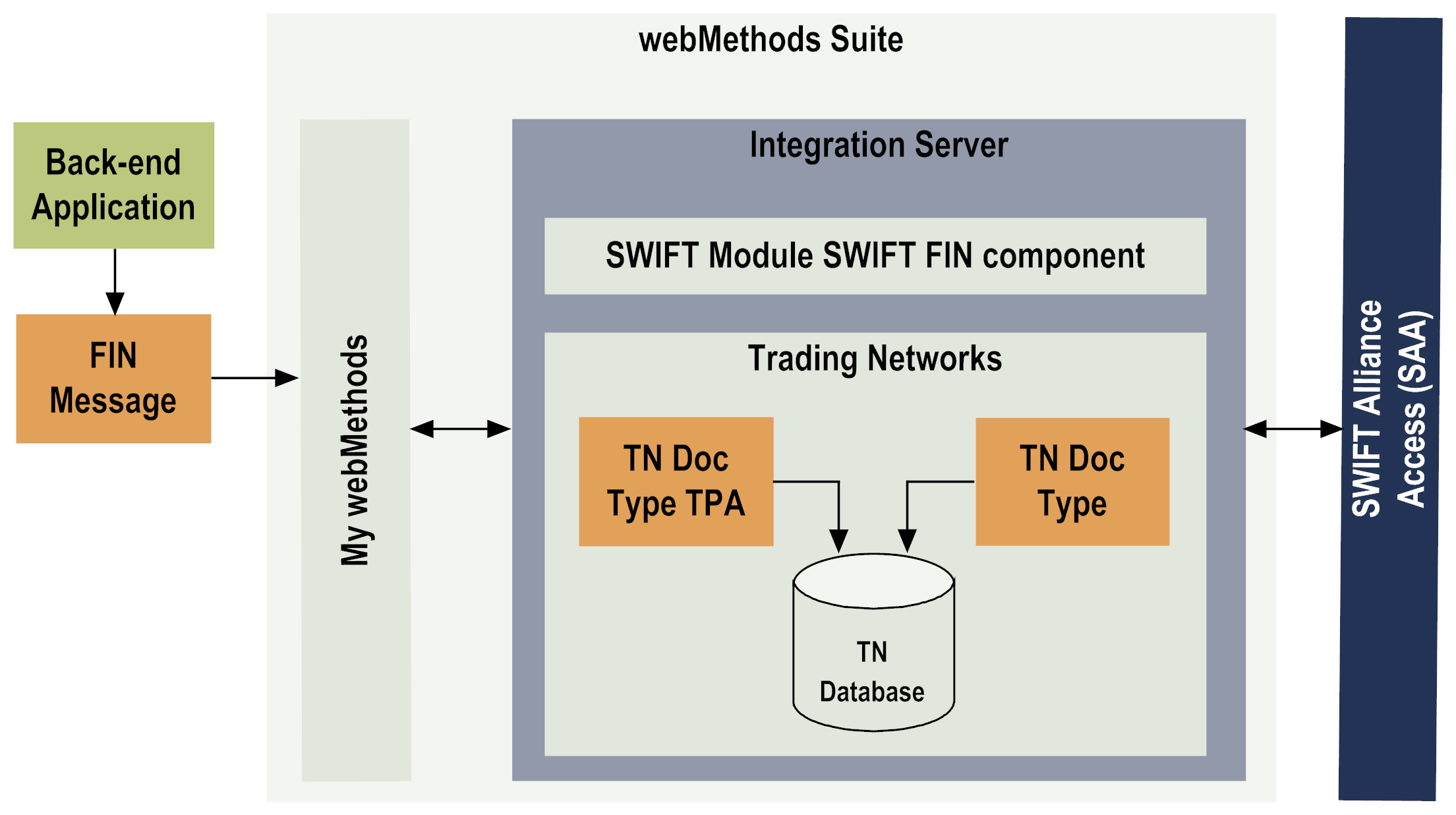

The following figure illustrates how the SWIFT FIN component interacts with other components. For further explanation, see the table that follows the figure.

Component | Description |

SWIFT FIN component | The SWIFT FIN component uses Trading Networks processing rules to manage the execution of SWIFT FIN messages. When the component receives a message from a back-end system, it invokes a Trading Networks service to recognize the message. For information about creating processing rules, see

Configuring Processing Rules to Send and

Receive SWIFT FIN Messages. |

Trading Networks | Trading Networks uses the information defined in trading partner profiles to enable your enterprise to link to the financial institutions with whom you want to exchange SWIFT FIN messages. You can customize TPAs and view TN document types when you create your message records. |

Trading Networks Database | The Trading Networks database stores TN document types, TPA, and trading partner profile information, among other things. |

Integration Server | Integration Server contains the documents, services, and IS documents that you need when creating your process models. Integration Server also contains the elements (services, triggers, and process fragments) that were generated by the automated controlled steps within the process model. |