Field | Description |

orderIdentifier | A unique identifier to perform operations on the order. |

serviceIdentifier | The name of the market service provider monitor to use, or an empty string to use any market service provider monitor. |

brokerIdentifier | The name of the broker to send the order to. To determine whether you need to specify this field, and obtain more information about the meaning of this field, see the documentation (this is often a README file) for the adapter you are using. If the documentation does not mention this field, you do not need to specify it. |

bookIdentifier | The name of the book the order should be accounted against. To determine whether you need to specify this field, and obtain more information about the meaning of this field, see the documentation for the adapter you are using. If the documentation does not mention this field, you do not need to specify it. |

marketIdentifier | The name of the market to send the order to. To determine whether you need to specify this field, and obtain more information about the meaning of this field, see the documentation for the adapter you are using. If the documentation does not mention this field, you do not need to specify it. |

exchange | The name of the exchange to send the order to. To determine whether you need to specify this parameter, and obtain more information about the meaning of this parameter, see the documentation for the adapter you are using. If the documentation does not mention this parameter, you do not need to specify it. |

symbol | The instrument to trade. |

price | The price to trade at, or 0 for a market order. |

quantity | The amount to trade. For example, the number of shares to buy or sell. |

side | BUY or SELL. Some services also support other values such as BUY MINUS or SELLSHORT. |

type | MARKET or LIMIT. Some services also support other values such as STOPMARKET or STOPLIMIT. If left blank, the order is placed as a LIMIT if a price is specified or a MARKET order if no price is specified (or is 0). |

extraParameters | Any extra parameters for the service. |

Field | Description |

orderIdentifier | A unique identifier to perform operations on the order. |

marketOrderIdentifier | An identifier supplied by the market, typically unique across all orders in that market. |

symbol | Identifier for the instrument being traded. |

price | The price requested either when the order was submitted or the latest modification. A price of 0.0 signifies a market order. |

quantity | The total number of units, such as shares, to trade, or the number the order has been amended to. |

side | The side of the order — BUY, SELL, or some other side supported by the market. |

type | The type of the order — MARKET, LIMIT, or some other type supported by the market. |

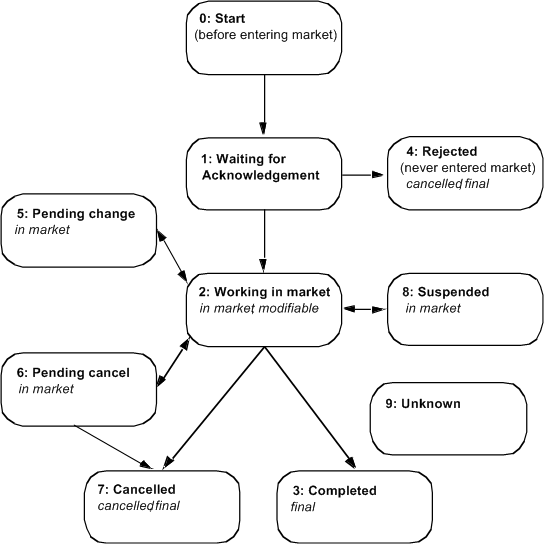

state | The order's state indicated by 0-9. See

Order states and status fields. |

moneyExecuted | The sum of price * quantity for all fills of this order, or 0.0 if no fills have occurred. |

averagePriceExecuted | The volume-weighted average price over all fills, or 0.0 if no fills have occurred. For example, suppose you place an order to buy 100 shares of IBM at up to $10.00 per share. You bought 20 shares at $9.95 and 20 shares at $9.97. The average price executed is $9.96. |

lastPriceExecuted | The price obtained per item for the last fill, or 0.0 if no fills have occurred. |

lastQuantityExecuted | The number of items traded in the last fill, or 0 if no fills of this order have occurred. |

quantityExecuted | The number of items traded so far, or 0 if no fills of this order have occurred. |

quantityRemaining | The number of items left to trade in the market as part of this order. |

inMarket | true if the order is known to the market. |

isVisible | true if the order is visible in the market. Some markets consider orders to be invisible until a certain condition has been met, for example, stop orders are invisible until the trigger price is hit. |

modifiable | true if the order can be modified immediately. The Order Manager sample queues any attempts to modify an order when it is not modifiable. The queued modification cannot occur if the order enters a final state before becoming modifiable. |

cancelled | true if the order has been rejected or cancelled, possibly before being entered into the market. A cancelled order might have had some quantity traded. |

changeRejected | true if the most recent modification or cancellation was rejected by the market. An explanation might be available in the status message field. |

externallyModified | true if the order has been modified, for example, by the market or a third party. |

final | true if the quantity specified for the order has been traded, or if the order was cancelled. |

statusMessage | A message from either the market service provider monitor or the market explaining what has happened. The format and meaning of the message varies from service to service and market to market. |

extraParameters | Dictionary that specifies additional parameters, which contain more information about the instrument being traded. |

Operation | Description |

SubmitOrder | Send the order to the market. The order automatically enters state 1, waiting for acknowledgment. |

ModifyOrder | Change the order in the market. The order automatically enters state 5, pending change, unless the order is not modifiable at this time. |

CancelOrder | Cancel the order in the market. The order automatically enters state 6, pending cancel, unless the order is not modifiable at this time. The market can reject a cancellation. Consequently, after an order is in the pending cancel state, it can become cancelled, completed, or, if the cancellation is rejected, working. |

CancelAllOrders | Cancel all orders. Note that the market might reject some cancellations. |

onOrderStatusAcknowledgement | This is a callback on order state updates. |