What is Automated Clearing House (ACH)?

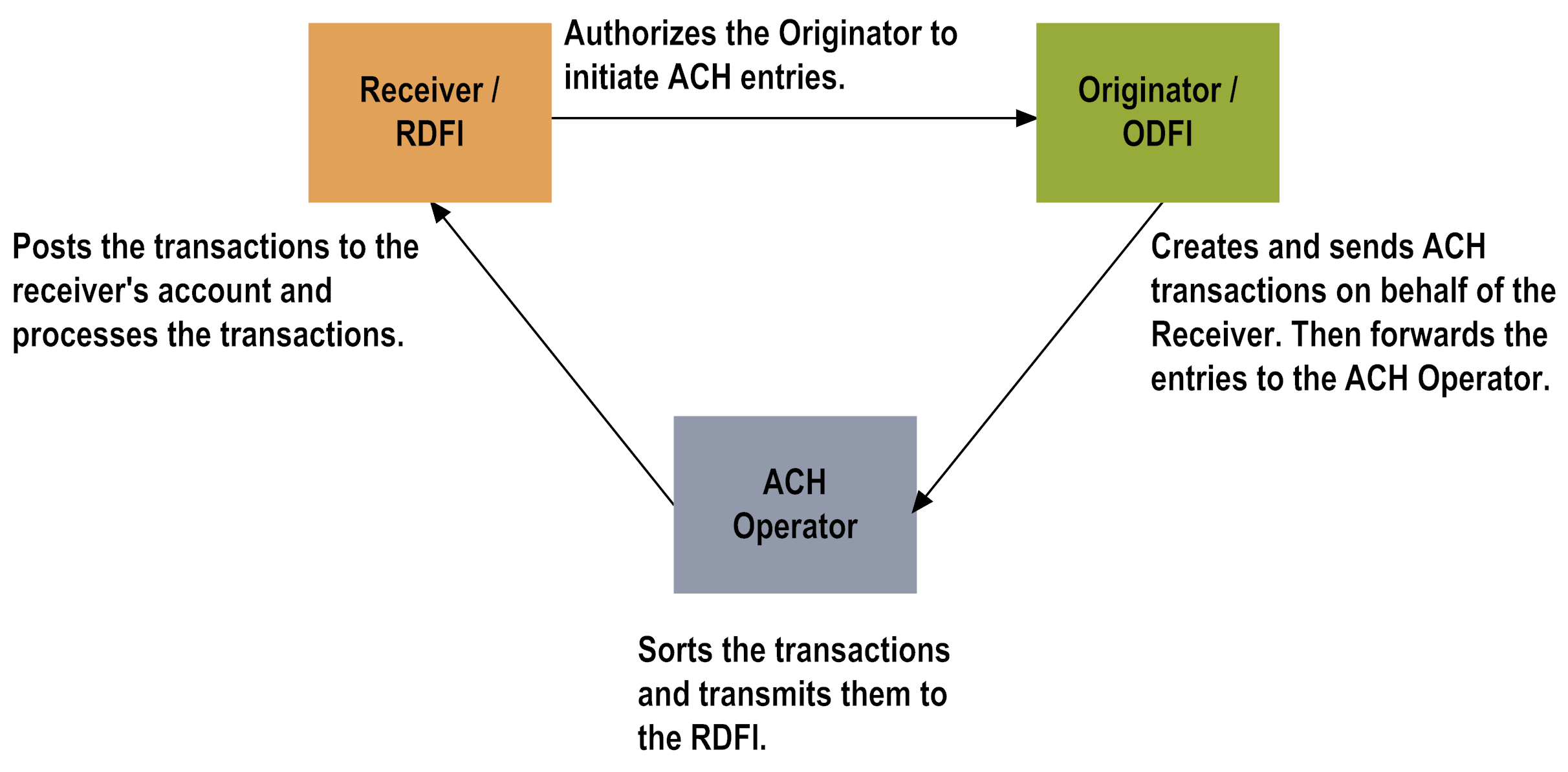

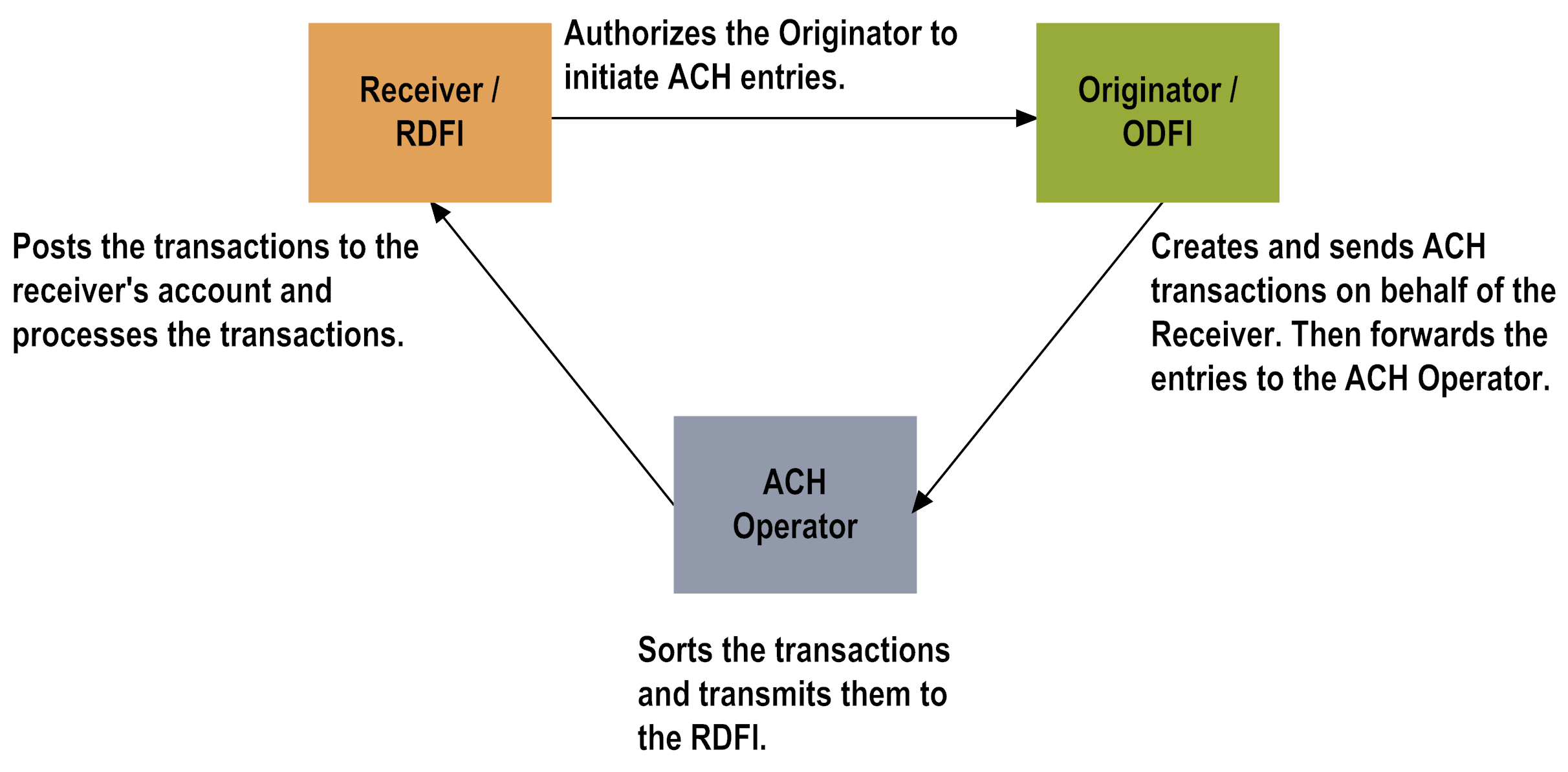

The Automated Clearing House (ACH) is a way to process payments with electronic transactions, replacing paper payments. ACH transactions are processed through the ACH network, which is a nationwide batch-oriented, electronic funds system that is governed by rules established by the National Automated Clearing House Association (NACHA) standards. The following diagram illustrates the ACH network:

Originator

Originator initiates credit or debit transactions on behalf of a Receiver. For example, these transactions might be direct deposit of payroll, direct payment of consumer bills, or E-checks. The Originator is responsible for packaging the transactions into an ACH file. For more information, see

ACH Files.

Originating Depository Financial Institution (ODFI)

Originating Depository Financial Institution (ODFI) receives payment instructions from the Originator and forwards the ACH file it receives to an ACH Operator. For example, an ODFI might be a bank.

ACH Operator

ACH Operator (for example, Federal Reserve) receives the ACH file. It sorts the transactions (entries) and transmits them to the Receiving Depository Financial Institution (RDFI).

Receiving Depository Financial Institution (RDFI)

Receiving Depository Financial Institution (RDFI) posts the transactions (entries) to the Receiver's account.

Receiver

Receiver must authorize an Originator to initiate credit or debit transactions on their behalf. These transactions go through the ACH network and are posted to the Receiver's account. The Receiver receives the transactions and processes the transactions.